Vision insurance 101: Your questions answered

Are things looking a little blurry? Are you squinting to see road signs, the TV — or even to read this blog? It’s not in your head. A 2016 report from the National Academies of Sciences, Engineering and Medicine found that as many as 16 million people in the U.S. have undiagnosed or uncorrected "refractive" errors in their vision that could be fixed with eyeglasses, contact lenses, or surgery.

Vision insurance plans can help you reduce eye care expenses and make your eye health (something we often take for granted) a priority. We rounded up answers to the most frequently asked questions about vision insurance to help you determine if it’s right for you.

Do I need vision insurance?

According to the National Eye Institute, two-thirds of Americans 18 and over report using glasses, contacts, or both. If you fall in that category, vision insurance is a no-brainer as it can help you save significantly on lenses, frames, contacts, and more.

Even if you have 20/20 vision, doctors recommend undergoing routine insurance-covered eye exams, as they can detect hidden medical problems, like diabetes. If you have a family history of eye disease or chronic illnesses, you may need to increase your frequency of eye exams.

Does health insurance cover vision care?

Having health insurance is a must for most Americans. And depending on your needs and medical history, it could be all you need to cover your vision care as well.

Health insurance will pay for one eye exam per year. But beware: that eye exam must be performed by a general practitioner — not an optometrist (eye doctor). If you make your appointment with an eye doctor rather than your general practitioner, you could end up shelling out major bucks since health insurance won’t cover the cost.

On top of that, if the doctor discovers any problems with your eyes that requires an appointment with an optometrist, that will most likely not be paid for by health insurance.

Conversely, if the eye exam reveals medical problems that require an ophthalmologist (medical eye doctor/surgeon), that may be covered under health insurance rather than vision insurance. So, for many people, opting for both is a good idea.

What does vision insurance pay for?

There are a lot of benefits to having vision insurance. Need a new set of specs? Vision insurance will often pay for a new pair of glasses every year. So you can change up your style with those costly frames at a discounted price.

The services covered by vision care will depend on your plan, but most insurance plans will pay for all or a portion of:

-

Eyeglass lenses.

-

Eyeglass frames.

-

Contact lenses.

-

Basic preventive care such as eye exams and vision tests.

-

Lens protection and enhancements for glasses (such as scratch-resistant coating and anti-glare).

If you want to upgrade your plan, many have additional coverage options for daily disposable contact lenses and discounts on corrective eye surgery such as Lasik.

How much does vision insurance cost?

The cost of vision insurance can vary, depending on where you get it and what level of coverage you have. Your employer may offer vision insurance at a rate that can be deducted from each of your paychecks. To take advantage of insurance from your employer, you must sign up during Open Enrollment periods, often offered just once per year, when you begin your job, or in the event of a major life change.

If you’re self-employed, unemployed, or choose not to opt in to your employer’s coverage, a health provider like Humana or VSP is a good option. And bonus: you can enroll in these plans at any time. These and other vision insurance companies offer premiums at less than $20 a month. When you visit the eye doctor, you’ll probably have to pay for a portion of your visit, called a co-pay. However, co-pays are often in increments of only $15, $20, $25, or $30. Score!

Unlike health insurance, vision insurance usually doesn’t include a deductible. So you’ll begin receiving benefits right away — without having to pay a certain amount out of pocket first.

Are vision insurance plans worth it?

The best vision insurance makes it easy to get the services you need at a cost that works for your budget and comes out cheaper than paying for everything out of pocket. That of course will depend on what you need and how much you use it.

With co-pays and a recurring premium payment, is the total cost you’ll pay for vision insurance worth it? Let’s break down the costs for an individual plan with VSP:

|

|

WITHOUT INSURANCE |

WITH INSURANCE |

|

Annual eye exam |

$181 |

$15 co-pay |

|

Premium |

— |

$16.94 monthly or $203.28 annually* |

|

Prescription glasses |

$298 |

$25 |

|

Lens enhancements |

$171 |

— |

|

Estimated total |

$650 |

$243.28 (including annual premium |

|

Estimated savings |

|

$406.72 |

*Based on VSP Basic plan for an individual in the state of Texas. Premiums may vary based on state of residence.

Where can I find low-cost vision insurance?

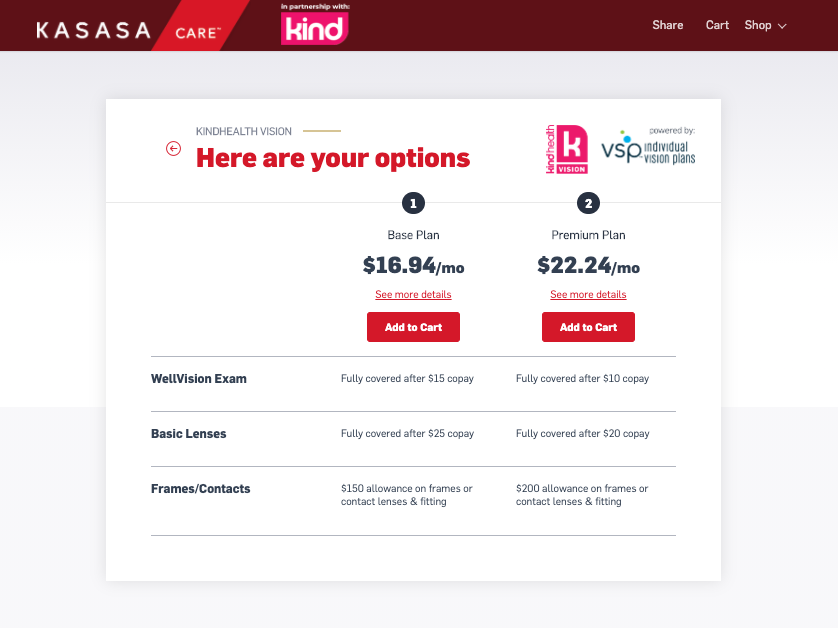

As we mentioned above, you can find coverage through your employer, a third-party insurance company, or medical provider. But did you know you may also be able to get vision insurance through Kasasa Care? Kasasa Care is an online marketplace that also offers low-cost vision insurance. Visit the site to see what plans are available to you.

When you’re looking for plans through an insurance provider, keep these tips in mind:

-

Some have waiting periods. If you need an eye exam, contacts or glasses soon, choose a plan that starts immediately.

-

Make sure the provider offers plans in your area. On the Kasasa Care digital portal dashboard, you can easily see what’s available in your ZIP.

-

Have an eye doctor you love? Use the provider directory to make sure the plan covers your preferred doctor.

-

Need other types of insurance? Many insurers offer vision coverage alongside other plans, like dental, at discounted rates.

We hope this gave you a 20/20 view of vision insurance basics. The bottom line? Getting vision insurance is a smart financial decision if you have any type of eye issues, a family history of eye disease, or other medical problems. Be sure to understand the ins and outs of the policies you’re looking at before you make a final decision.