Why bother with identity protection?

Dealing with the aftermath of financial identity theft is time-consuming, costly, and stressful. If you are a victim, you could spend untold hours on phone calls to credit card companies and your financial institution to cancel unauthorized accounts. And let's not forget time spent reporting fraudulent chargers to vendors and credit reporting agencies.

You might even worry over temporary hits to your credit score. These take a toll and require hours of legwork, thousands of dollars, and sleepless nights before the issue can be fully resolved. The theft isn't even the biggest headache; fixing it is!

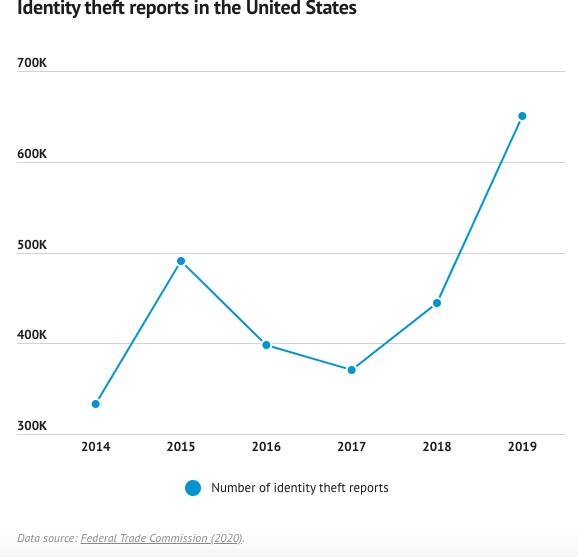

Unfortunately, the threat of identity theft isn’t going away any time soon — in fact, it’s on the rise. Identity theft cases doubled from 2017 to 2019. With the popularity of online experiences (like tele-health and online banking) this is a crucial statistic to keep in mind. Your personal information is, well, everything, and understanding how to best protect what’s rightfully yours is important. That's why it's important to equip yourself with the proper knowledge and tools to take action.

What is identity theft?

First, let's take a step back. What is identity theft? It's when your personal information — name, birthday, Social Security number, or bank/credit card numbers — is stolen by cybercriminals who can financially gain from it by opening accounts, lines of credit, or selling your information on the dark web.

How common is identity theft?

With the number of reported cases of identity theft on the rise, chances are you or someone you know has already been a victim. Consider these facts from 2019:

-

650,572 reported identity theft cases

-

165 million records exposed by third-party data breaches

-

100 million consumers affected by the Capital One breach alone

-

The average cost of resolving identity fraud in 2019 was $2,895

And check out these numbers from the Federal Trade Commission, which tracks cases of identity theft:

Fraud is an ever-growing threat. According to the Ascent, from 2017 to 2018, the number of reports increased by 19.8%. From 2018 to 2019, there was a 46.4% increase. 2019 had the highest numbers for identity theft so far — and the numbers for 2020 are already grim.

Large-scale corporate data breaches are a big reason for these troubling increases in identity thefts. The 2017 Equifax data breach (147 million affected consumers) and the 2019 Capital One breach (over 100 million affected consumers) were two of the largest to date.

On July 19, 2019, a cybercriminal was able to access the personal data of more than 100 million unsuspecting Americans and 6 million Canadians in a breach of Capital One’s databases of information. Compromised data included personal information (name, address, social security numbers, birthdates) and financial information (income, credit score and credit limits, current balances, payment histories, and bank account numbers).

Even applying for a credit card puts your personal data in large databases that can be and have been recently targeted by cybercriminals. The 2019 Capital One data breach had very real consequences for those affected — both customers and people who had simply applied for a credit card.

Is identity theft protection worth the cost?

With your all-important credit rating at stake, it’s better to be on the defense — especially if you expect to make a major purchase or lifestyle shift soon. Want to buy a house, go back to school, start a family, or get serious about retirement investing? Better make sure that credit rating you worked so hard for stays safe from the hands of fraudsters.

To determine whether identity theft protection is worth the cost, it's first important to understand exactly what to expect. Typically, there are three types of services offered: credit services, identity services, and restoration services.

-

Credit services is the regular checking of credit reports for indications of fraud.

-

Identity services is the tracking of personal data on the dark web and in public records.

-

Restoration services is assistance provided by the identity theft service companies to help customers to recover from identity theft. In certain cases, insurance is available.

Most financial institutions and credit card companies offer complimentary identity theft protection or credit monitoring that come standard with your accounts. This is usually a free service promising to alert you of any suspicious activity on your account.

These standard services, though, have some unsettling drawbacks. They are normally retroactive — meaning the fraud has already occurred by the time you are notified. And you, the consumer, will need to do the legwork to fix the issue: alerting vendors and creditors that fraud has occurred, proving that the charges were unauthorized (signed statements, etc.), and waiting on charges to be reversed. You may even need to contact credit reporting agencies to fix any dings on your credit.

If you’ve already had your identity stolen at one point, or if your data was exposed in a breach, you may want to seriously consider identity theft protection.

How can you protect yourself from identity theft?

There are lots of options for consumers concerned about identity protection, but many find it difficult to find the right solution for their situation. Some companies offer services so expensive they are cost-prohibitive, but more affordable plans may offer less diligent monitoring.

A better option, available through Kasasa Care™, is one that offers 24/7 credit monitoring (including internet surveillance to identify if your information is being sold on the dark web), lost wallet protection, 24/7 accessible support, and complete identity restoration in the case of identity theft or a data breach — for just $8 a month. There are also two other pricing structures for you and up to 10 family members, so you have control over the kind of protection that works best for you and your loved ones.

Identity theft is very real and can be very scary. Lost time, all those phone calls, temporarily missing funds, worry over possible credit dings. So choosing an identity theft protection plan that works for you and your family rather than pay for the long-term consequences of identity theft is a smart idea. Affordable options are available (ahem, $8 per month) and much more cost-effective than leaving your personal and financial information vulnerable on the internet.

Don’t sleep on cybercrime. Instead, sleep well knowing you and your personal and financial information is safely guarded, monitored, and insured.