How does identity theft happen?

Identity theft has become big business for criminals as the issue continues to plague Americans. In 2019, the Consumer Sentinel Network (an investigative cyber tool and complaint database that provides civil and criminal enforcement organizations immediate and secure access to identity theft, internet, telemarketing, and other consumer related complaints) took in over 3.2 million reports, totaling $1.9 billion in losses. The top category reported? Identity theft.

Credit card fraud topped the list of identity theft reports in 2019. The FTC received more than 271,000 reports from people who said their information was misused on an existing account or to open a new credit card account. In fact, credit card fraud has topped the list of most commonly reported identity thefts since 2015.

Other types of common identity theft reports include:

-

Other identity theft (including email and social media fraud)

-

Loan or lease fraud

-

Phone or utility fraud

-

Bank fraud

-

Employment or tax-related fraud

-

Government documents or benefits fraud

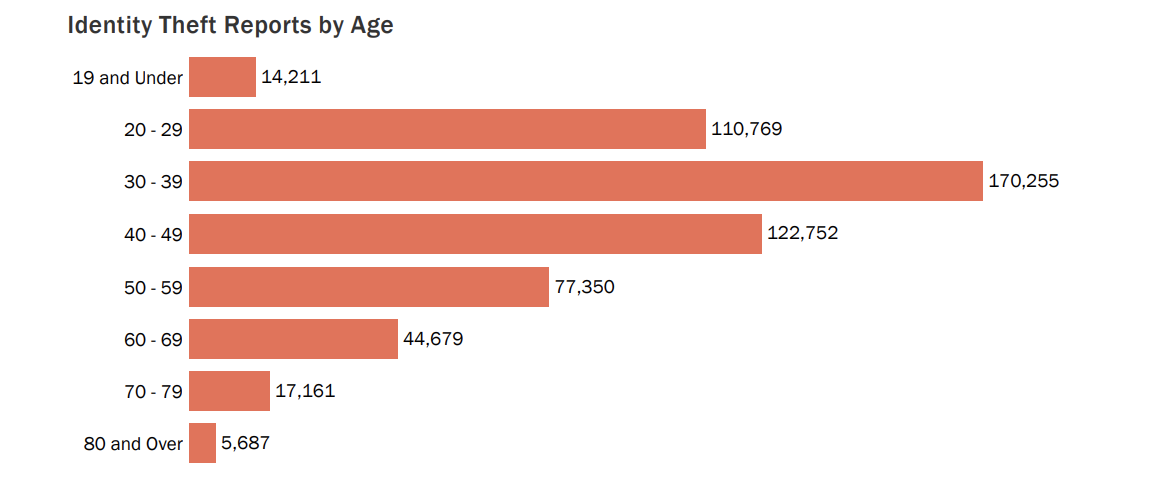

Identity theft by age

Although it was more common for younger people to report an identity theft, when older people did report, the loss they experienced was monetarily greater.

Those aged 70 and older reported much higher median losses than any other age group, anywhere from $800 - $1,600 while those aged 20-29 lost $448.

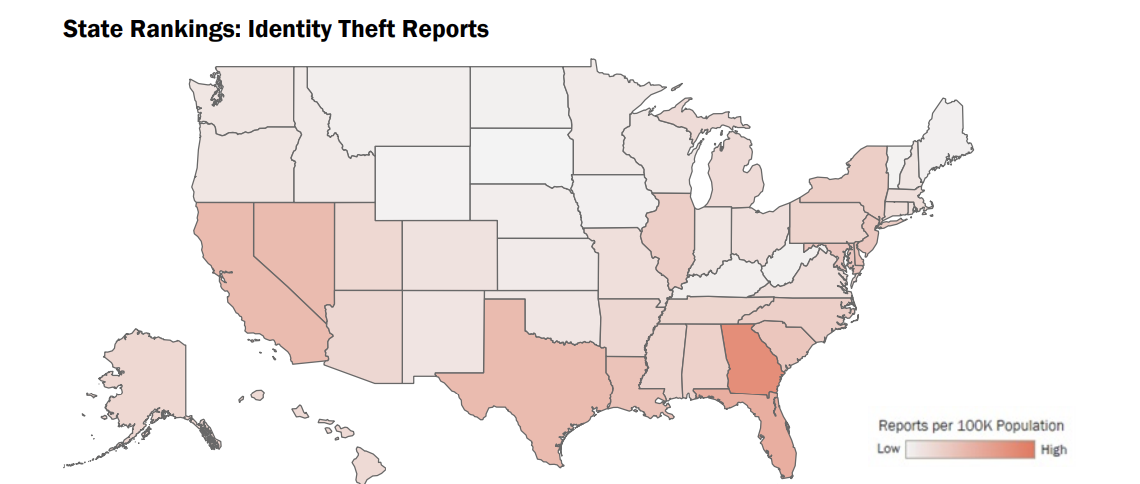

Identify theft by state

Topping the list for most incidents of reported identity theft in 2019: Georgia, Florida, California, Texas, and Nevada.

Because we live so much of our lives online, our personal information is continually at risk. As it travels through cyberspace, it can be stolen and used for fraudulent purchases, credit card or bank account applications, tax filings, and a host of other things that can severely damage your credit or cause other financial headaches that are hard to recover from. Luckily, there are ways you can (and should) prevent yourself from becoming yet another victim to identity theft.

Electronics such as smartphones and tablets

Many of us bring our phones and tablets everywhere we go, or leave a laptop on a table at the library or coffee shop while we duck into the restroom. These devices contain personal emails, banking access, and stored passwords that can be quickly captured by identity thieves. Using passcodes, locking your devices when not in use, and installing the appropriate software updates can do a lot to prevent identity theft from your electronics.

Online data

We do so many things online these days, such as online shopping, and online banking. These types of activities can expose us to identity theft through unsafe connections, password security issues, and insecure websites. To prevent becoming a victim of identity theft, use an antivirus software and firewall, only shop through secure domains (signified by “https” in the web address), and take the time to come up with unique, hard-to-guess passwords that do not repeat from site to site.

Online scams

Even the most careful email users have been vulnerable to sophisticated email scams. Referred to as “phishing”, these often come across as emails from trusted sources, such as departments at work, or your bank, and request that you confirm personal information, such as social security numbers or dates of birth. These are then used to steal your identity. Carefully reverse check the email address that request personal information – you will often spot spelling mistakes and inconsistencies that tip you off about these being fraudulent. Also keep in mind that personal information is usually verified in person or by phone, but by email.

Not all identity thieves are digital

Identities were being stolen long before the world wide web. It's important to monitor not only your digital world, but your physical one too.

Lost or stolen wallet or bag

Ever lost a wallet? Left a handbag behind in a public place? These items typically contain a wealth of personal documents: credit cards, social security numbers, licenses, and even passports. Identity theft criminals can use these to make unauthorized purchases with your credit cards, open new lines of credit under your name, obtain housing, and apply for loans.

Keep a close eye on your belongings when you are out and about or traveling, and take pictures of all documents (front and back) so you can quickly report them lost or stolen. Most banks and credit cards feature fraud protection – but you need to report potential fraud as soon as there is any cause for concern.

Trash and recycling

It's hard to imagine identity thieves going through your trash, but it is a common practice. Anything you dispose of in residential or business trash or recycling containers has the potential to be captured by identity theft criminals. Protect your information by utilizing a shredder for anything you are throwing out or recycling that contains personal information.

Snail mail

Even in today’s digital world, we still rely heavily on regular mail. If you use an unsecured and unlocked mailbox, you run the risk of identity thieves getting their hands on the personal information contained in your tax documents, bank and loan statements, or taking advantage of pre-approved credit card or financing offers in your name. Subscribing to electronic bills and statements and using a locked mailbox or mail slot in the front door can protect you from this type of identity theft.

Preventing identity theft takes some planning and diligence, but it is much easier than recovering from it. If you confirm that your identity was stolen, you can work directly with your financial institution and creditors to change account numbers and have them watch for fraudulent activities. In serious cases, you may need to utilize a paid recovery service to help, which can track activities that occur in your name and notify you quickly. In extreme cases, people have had to declare bankruptcy to start fresh with their financial and credit history.