10 Important facts about debt

1. Americans are anchored by credit-card debt.

Despite the drop in credit card debt in 2020 (and an increase in 2021), the average American household holds nearly $90,500 in total loan debt. From student loan debt to mortgages or a simple personal loan, according to Debt.org, total household debt in America increased by 6% from 2019 pushing up to $14.6 trillion. For even the most savvy borrower, that's a doozy of a monthly payment!

Credit card debt, however, is held by homeowners and renters, college graduates or Americans who entered the work force with a high school diploma of GED, so it is understandable that credit card debt spans across all demographics of the country. Almost half of Americans carry credit card debt to the tune of $807 billion, with the average interest rate hovering near 16%.

2. Yes, there is such a thing as good debt.

Of course, not all loan debt is bad - how else would you pay the mortgage on the roof over your head and build good credit without loans? For many, a student loan is the only way to cover the cost of tuition for trade school or an advanced degree. In 2020, total student loan debt increased by 12%, the largest percentage increase across all loan types.

Once that degree is in hand, the opportunity for higher income often improves for college graduates, as does the average amount of debt. Again, this may not be bad, as it offers a borrower the ability to make a larger loan payment, which can pay down loan debt more quickly and improve their credit score. A better credit score often leads to an improved loan term and a lower interest rate in the future — all good things.

Also, know the obligations for both private student loan debt versus a federal student loan and keep tabs on the changing guidelines for student loan forgiveness. These impact your student loan debt in good ways, but can also impact student debt in the future as policies change.

Borrowing for college, or any purpose, often serves as a useful necessity with long-term benefits. Just make sure you don't borrow more than you can afford to pay back, and always shop around for the best interest rate.

3. But most debt is bad.

If you can't afford to make your monthly loan payment or erase your credit card debt in a month or two, it's time to halt credit card use. Don't use credit cards to purchase things you consume quickly, such as meals and vacations. It's the quickest way to fall deeper into debt and that's a tough climb back — as the interest builds and accumulates, your repayment plan becomes less likely.

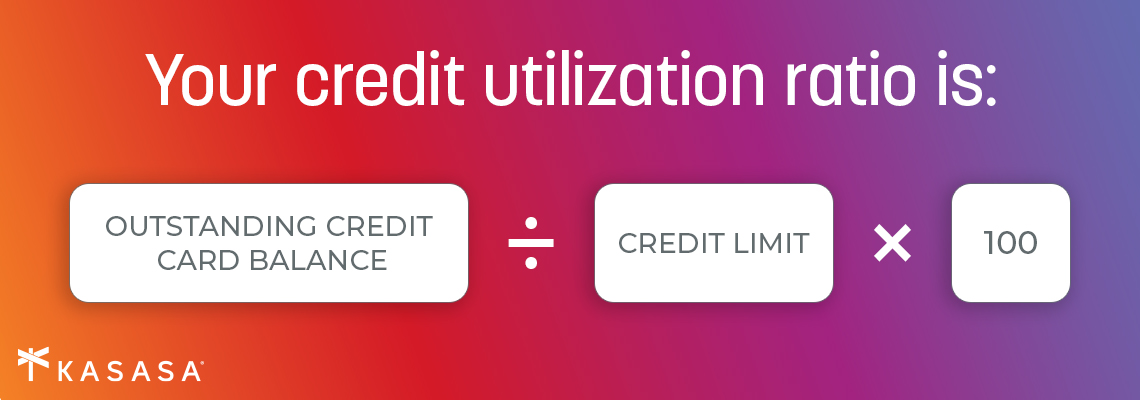

If you notice your loan debt increasing as part of your monthly budget, debt consolidation might be a beneficial option. With a lower interest rate and a single payment, you can rein in your monthly payment. Keep in mind a debt consolidation loan requires the same application process as any other loan, so that lower interest rate may not be available to you if you have already exceeded your credit utilization score (how much of your available credit you have used).

Try to keep your credit utilization under 20%, especially when you know you might have plans to take out a new loan for a car or home. Focus on using your loan debt effectively before you find yourself needing debt relief.

4. Control your spending.

Much like going to the grocery store for one or two items and buying a cart full, it is easy to spend hundreds or even thousands of dollars with a quick swipe of your credit card. A better practice is to log all of your monthly spending, cut back on things you don't need, and start saving the surplus or put it towards reducing your overall debt.

Compiling a budget with a plan to pay bills in full and make each monthly payment on time and within your means adds up to a best practice for managing any loan debt. If there's something expensive you really want, save for it over a period of weeks or months before charging it, that way you can pay the balance when it's due and avoid accumulating interest charges.

Talk to a local banker or loan officer at your credit union to understand if and when a debt consolidation loan might also help your bad debt become better managed and streamlined.

5. Pay off your highest-interest debts first.

When you find yourself in a position to pay ahead on your outstanding debt, first pay down those balances with the highest interest rate, while paying at least the minimum due on all your other debt. Once you've eliminated the high-interest debt, tackle the next highest interest rate using the same process.

For example, credit cards tend to have the highest interest rates, so doing everything you can to pay the balance in full will likely yield you immediate results to your budget and your credit score. Your student loan payment pay only have a 6% interest rate, so whittle away at that debt before your car payment with a 3.9% interest rate. Just keep making the monthly payment until your credit card balance in paid in full each month, and your student loan is a thing of the past.

Here's what's important: know the interest rate on your outstanding student loan debt, your credit cards, and all your outstanding debt so you can attack your repayment plan.

6. Pay more than the minimum.

This is credit card management 101: don't just pay the minimum monthly payment due. You'll barely cover the interest for the current month, and good luck trying to cut into the principal you owe. Credit card statements are required to tell you how long it will take to pay off the existing loan debt (not to mention anything you add on after the billing cycle date).

It could take you years to pay off your balance, and you'll likely end up spending thousands more than what you originally owed. Your credit card will provide you with that number - don't ignore it — it will remind you of why you want to make more than the minimum payment.

In fact, when you open any loan (including credit cards), plan for the loan term to include a lower monthly amount than you can afford. This will give you both wiggle room when unexpected purchases arise, and the ability to pay more than the minimum amount due.

7. Watch where you borrow.

It may be convenient to borrow against your home or your 401(k) to pay off another lender, but it can be risky. Best-case scenario, you create a situation that may make the next few months more challenging. Worst-case scenario, you lose your home or fall short of your investment retirement goals.

In the near term, it's hard to think about your long-term investment when you have a loan payment due right now. Many student loan borrowers, for example, don't ask about possibilities for deferment from their student loan servicer. Blocking out time to deal with the debt in front of you will keep you from putting an unwanted dent in your long-term savings.

Where you look when you need to borrow money may also be as close as your local bank or credit union. Having a conversation about your debt and your budget with a community banker may help you build a plan to solve for today and tomorrow. Megabanks may be less likely to be accommodating when you are in a pinch.

Establishing a relationship with a community financial institution in your neighborhood that can offer practical advice, plus help you manage all your financial products and investments, may help you see the bigger picture - all to your advantage.

8. Always be prepared.

This is one you probably already know, but it isn't tricky to kick-start: have a rainy-day emergency fund. Building up your savings to allow for a three to six-month cash cushion will always give you that what-if peace of mind when a major car repair, or a shut down at work, or a natural disaster, or, yes, a pandemic, come barreling into your budget.

If you have to, just start small. Keep a change jar. Ask about savings accounts that round up to the nearest dollar when you use your debit card. Find an extra $10 in your weekly expenses. Maybe consider a side hustle that allows you to save when you need it and stop when you have that extra buffer in the bank. Without an emergency fund, unforeseen expenses can cripple your finances.

9. Don't be so quick to pay down your mortgage.

From the time you closed on your house, you've been fantasizing about the day when you will make the final payment. But remember, there's such a thing as good debt and your mortgage is helping you establish a solid basis for an excellent credit rating.

Don't pour all your cash into paying off a mortgage if you have other debt. Going back to Fact 5, mortgages tend to have lower interest rates than other debt, so it's worth your while to put your extra payments towards other debt. Also, you may deduct the interest you pay on the first $1 million of a mortgage loan, so take advantage of that perk.

With interest rates and remarkably low levels, if your mortgage has a high rate and you want to lower your monthly payments, consider refinancing. You may encounter upfront costs, which may not fit into your budget right now, but if you talk to a home loan specialist at your credit union or bank, they might be able to see if it is to your advantage and what you'll need to pull together - such as paperwork and documentation - and if it would be beneficial for your situation.

10. Get help right when you need it.

If you have more debt than you can manage, get help with your finances before it breaks you. Lots of people don't like to ask for help, but there are reputable counseling agencies that can help with debt consolidation or just assist you in managing your finances. But make sure you do your homework — there are also a lot of disreputable agencies out there, too.

Student borrowers have options to help with student loan repayment, so do a little research and ask a lot of questions. In the end, it may help you see the light at the end of a debt tunnel. There may be options for debt cancellation or debt relief that you may not know, so find reputable resources and not-for-profit organizations who can assist.

As squishy as it might feel in the moment, meet with a credit adviser or loan officer at your local bank or credit union to discuss openly and honestly about your debt. They can easily become a partner and resource to help you develop a financial plan to avoid future debt debacles and reduce your dependencies on short-term solutions. You may qualify for a debt consolidation loan, and you may find out you're more on track with managing your debt than it feels just looking at your budget by yourself.

Getting smart about your debt, applying these insights, and keeping on top of your expenses can all help you move towards the "good debt" side of the equation.

Free checking. Cash rewards. (And zero catch.)

Your guide to using personal loans for debt consolidation

02/10/2022

Which debt consolidation loan is right for you? There's no one-size-fits-all answer, but we can…

Read MoreThe ABCs of finance: Terms to empower your bottom line (letters D-L)

04/01/2023

Have you ever wished for a pocket glossary when dealing with your finances? Here are more…

Read More

APR vs. Interest Rate: What Do They Really Mean?

04/01/2020

Knowing the difference between APR and interest rate can save you money when you decide to take…

Read More